Ford calls for stricter regulation of used car sales

New motor vehicle sales have been picking up dynamically in Hungary, with Ford keeping its supremacy on nearly all fronts. The company says numbers would be far more impressive, however, if legislation were used to cut mass imports of units of obsolete technology.

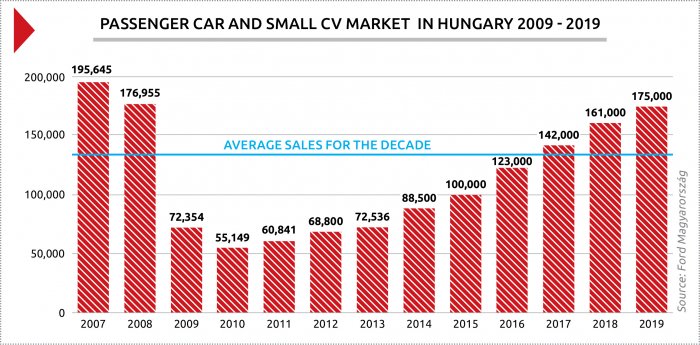

The year 2017 was the first since the recession where new motor vehicle sales figures in Hungary surpassed the average of the past decade. The total number of 142,000 units sold indicates a growth rate of some 15% compared to 2016, and even though pre-recession highs of 195,000 are still some way off, the sector seems to be back on the road to its former glory.

More importantly, private buyers, who have been shying away from opening up their wallets, seem to have regained their courage. Last year they accounted for 40% of new motor vehicles sold. If you add in sales generated by micro-enterprises, which typically buy just one unit at a time for the owners themselves, quasi retail carved out some 70% of the pie.

Ford has a lot to be cheerful about. For the eighth time in a row, the brand ranks number one on the list of total new motor vehicle sales (the combined sales of passenger autos and small commercial vehicles), with a current market share of 11.8% and 16,033 units sold. When you look at passenger cars alone, Ford was in second place with a 9.8% share, behind Suzuki on 13%.

Wide Spectrum

“Our success is primarily due to the fact that we perform well not just in one single segment,” Viktor Szamosi, managing director of Ford Magyarország at a press conference called to look at the success of 2017 and the plans for 2018. “We probably cover the widest spectrum of motor vehicle segments and our models rank high in nearly every category.”

Accordingly, Ford can pride itself on scoring high in the Transit (light commercial cargo van) segment, but it also leads corporate fleet charts, as well as the non-premium sports car and pick-up segments. Its supremacy is most apparent in the Small CV segment, where the American giant is responsible for selling almost every fourth motor vehicle in Hungary. Fiat is second placed, some 10% behind.

Viktor Szamosi, managing director of Ford Magyarország

A raft of new models scheduled for 2018 hints at a further market offensive by Ford. In total, ten brand-new or fully redesigned models will arrive, with all expected to do well, representatives of the car maker said. However, Ford believes it would take a legislative change to enable another substantial breakthrough to happen.

“In 2017 some 150,000 used cars were imported, most of them of obsolete technical condition,” highlighted Szamosi. “Hungary is among the seven EU countries with no CO2-based taxing, so if stricter regulation came into force, it would surely have a market cleansing effect. In addition, new car sales could soar by up to 50,000 per year.”

In the meantime, access to financing remains a major engine for further growth. Here Ford Credit, the brand’s in-house solution assumes a key role, and not just for new autos but used cars and insurance as well. Given the low interest environment, it should come as little surprise that retail customers have been seeking financing in doves: 20% of total new car sales involved Ford Credit.

Bottlenecks for Growth

Improving sales figures goes hand-in-hand with network expansion. Two Ford establishments have opened recently in Budapest and in Kaposvár, with two more expected to follow at some point in the near future. “It is not infrastructure but human capital that matters, though, as lack of talent causes bottlenecks for growth,” emphasized Attila Dalos, director of sales of Ford Magyarország. Accordingly, a comprehensive training program targeting technical and sales positions is underway under the guidance of consultancy Develor.

It is positions requiring manual labor that are hardest hit by the labor shortage. “In Szentendre, our 500-strong headquarters is home to highly skilled employees and it has evolved into a European service center of finance, logistics and pricing. Just last year we recruited 100 new staff,” said Dalos. But if that is the good news, the talent pool is far shallower for mechanics.

“The recent wage increases of up to 30% constitute only a short-term solution. In the longer run, such manual labor professions must be made more attractive,” Dalos noted. The company has, therefore, launched its own nationwide career program, which aims to provide new blood and reestablish the reputation of being a car mechanic, in close cooperation with six secondary schools.

But what about e-cars? The Ford Motor Corporation is well-known for being a champion in the field, and says it is investing USD 4.5 billion into the technology up to 2020. As Szamosi said, big changes are to come about at around that time, but that won’t affect the normal product development curve. That implies that the appeal for cross-overs and SUVs is expected to continue to prevail.

“I wouldn’t give too much thought to the e-revolution at this point, though,” Szamosi noted. “We’ve got other homework to do now; namely, why don’t we push the market towards having more modern Euro6 engines to start with and cut the number of imported used cars that are in bad shape dramatically? That would do as step one.”

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.