A Long Road to Recovery Ahead for Hungary

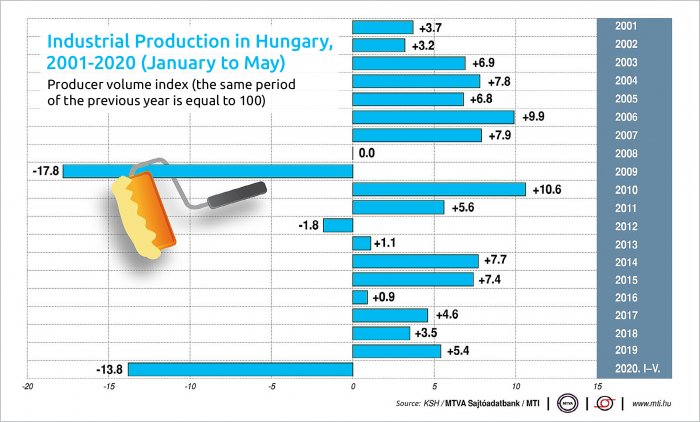

Although the industrial output reading in May was a slight improvement from April, the impact of coronavirus clearly continued to constrain industrial activity.

The economic outfall of the pandemic still had a significant effect on production in May: according to a second estimate of industrial production, output declined by 30.7% on a yearly basis in the fifth month of the year, a reading unchanged from the preliminary data published on July 7.

Based on working-day adjusted data, production fell by 27.6% year-on-year. However, there was a slight slowdown, with the industrial output 15.6% higher than in April, according to seasonally and working-day adjusted indices.

An outstanding fall was observed in the manufacture of transport equipment (which represents the largest “weight” in production), while the manufacture of computer, electronic and optical products, as well as the manufacture of food products, beverages and tobacco products declined to a lesser degree.

Within industry, production fell by 32% in manufacturing (representing the decisive weight of 95%) and it dropped by 18.5% in the much less significant mining and quarrying. The output of the energy industry declined by 6.2%.

Production volume decreased in all manufacturing subsections. The manufacture of transport equipment (representing 21% of manufacturing output) decreased at the highest rate, by 53% year-on-year.

The volume of motor vehicle manufacturing fell by 55%, the manufacture of parts and accessories for motor vehicles by 54%.

The manufacture of computer, electronic and optical products (accounting for 13% of manufacturing) declined by 21%. Of the two largest groups, the manufacture of electronic components and boards rose by 22%, while the manufacture of consumer electronics decreased by 25%.

Pharma on the Rise

The manufacture of food products, beverages and tobacco products (with a 13% share in manufacturing) was less affected by the epidemic. The volume of production was 12% lower compared to the same month of the previous year, with decreases measured in both sales directions.

Meat preservation and processing, and the production of meat products (representing the largest weight at 23%) fell by 19.5%; the manufacture of beverages, the second most significant group dropped by 10.1%.

Production grew in three groups altogether. Of the two carrying the smallest weight , the processing and preserving of fish, crustaceans and mollusks went up by 12.9%, the manufacture of tobacco products increased by 5.6%, while the manufacture of vegetable and animal oils and fats, having a greater weight, rose by 9.8%.

Among the medium-weight representing subsections, the manufacture of rubber and plastics products and other non-metallic mineral products decreased by 27%, while the manufacture of basic metals and fabricated metal products dropped by 33% year-on-year.

The manufacture of basic pharmaceutical products and pharmaceutical preparations declined by 3.4% only year-on-year, meaning that an increase was measured compared to April 2020.

Slow Rebound Expected

Although in a month-on-month comparison industrial output grew some 15%, there are worrying signs that indicate a slow recovery: the volume of new orders in the manufacturing sector was down 38% in May from a year before. New domestic orders fell by 30%, while new export orders were down by 39%; therefore, a fast recovery for the Hungarian industry is highly unlikely, analysts say.

According to ING analyst Péter Virovácz, although a slow recovery had begun, reaching pre-pandemic levels of productivity will be a much longer process than the two months it took the economy to tank.

Reopening the economy after the epidemic has helped various sectors unevenly, Virovácz said, with car manufacturing lagging behind. He thinks that the sector’s performance will improve in the coming months before slowing again in the fall. Also, he said there was little chance for a rebound to pre-pandemic levels this year.

Takarékbank head analyst Gergely Suppan said the rebound may be boosted by large car manufacturers picking up production in the coming weeks. Other plants are also expected to start operating shortly, which may help a gradual recovery in the coming months.

Industrial output may fall by 7-8% in 2020 and rebound by as much as 12-13% from that low base in 2021, he said.

FocusEconomics Consensus Forecast panelists project industrial production to contract 9.1% in 2020, which is down 0.6 percentage points from last month’s projection. For 2021, the panel sees industrial output growing by 7.7%.

Numbers to Watch in the Coming Weeks

The last two weeks of July will be relatively calm when it comes to macroeconomic data. The Central Statistical Office (KSH) will publish the April-June labor market figures on July 29. In the March-May period, the unemployment rate was 4.1% and there were 97,000 fewer people employed than a year before, a consequence of the novel coronavirus pandemic. After construction output was down more than 20% in May on a yearly basis, it will be interesting to see the number of construction permits in the first half of the year: that data will be released on July 30.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.