The U.S. Repo Market: A Harbinger of Recession?

Recent irregularities in the U.S. repo market may be early indicators of an upcoming recession, as was the case in 2008-2009 and before the dotcom crash of 2001, Les Nemethy and Sergey Glekov warn in their regular corporate finance column.

The repo market is crucial for the health of the financial system, as it used by banks to obtain short-term liquidity and the size of the repo market is substantial: according to data from the Securities Industry and Financial Markets Association’s US Repo Market Fact Sheet published this year, the average U.S. daily repo and reverse repo outstanding was USD 3.9 trillion in 2018.

Hence, the recent turbulence in repo markets should be of interest not just to bankers, but to any astute observer of the financial system, who wishes to have a deeper understanding of the direction in which markets are headed.

The Federal Reserve Bank of New York defines the U.S. repo market as the federal funds market that consists of domestic unsecured borrowings in U.S. dollars by depository institutions from other depository institutions and certain other entities, primarily government-sponsored enterprises.

In an overnight repo transaction, holders of U.S. Treasuries and other bonds sell their securities to other institutions with allowance made to repurchase those securities the next day at a set price. The difference between the sale price and the repurchase price is the effective borrowing interest rate, or the Effective Federal Funds Rate. This EFFR is calculated as a volume-weighted median of overnight federal funds transactions.

Repos are sometimes known as “sale-and-repurchase agreements” or “repurchase agreements”. In a repo transaction, one party sells an asset (usually fixed-income securities) to another party at one price and commits to repurchase the same asset from the second party at a different price at a future date.

If the seller defaults, the buyer takes title to the asset and may sell the asset to a third party to offset his loss. The asset therefore acts as collateral and mitigates the credit risk that the buyer has on the seller. Repos may be overnight (e.g. a duration of one day) or term (a duration up to one year, but typically up to three months).

Ideally, collateral should be free of credit and liquidity risk, therefore government bonds are most commonly used collateral in the repo market. In the United States, Treasury securities account for about two-thirds of the U.S. repo market, according to Repo FAQ by International Capital Market Association.

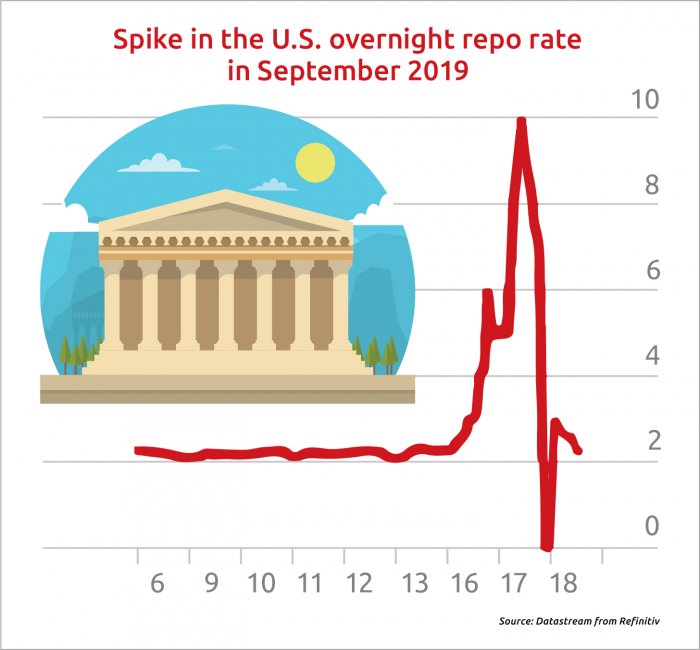

The exhibit below illustrates the rather nasty gyration that occurred in mid-September 2019 as it shows the intraday US repo rate. The spike signifies that liquidity in the system was freezing up.

To restore liquidity and counteract the spike, between September 17-24 the New York Fed injected a whopping USD 270 billion into the banking system and committed to continuing daily repo operations through October 10, 2019. The Economist magazine called this event “an alarming echo of the financial crisis”.

At the beginning of October, the New York Fed announced a further extension of daily repo operations to November 4, 2019. Those efforts have succeeded in calming markets for now. The EFFR decreased significantly over last month. However, money market stress is expected to rise again towards the end of the year, when banks concerned about liquidity requirements may be less willing to lend their reserves (see “New York Fed offers to inject more liquidity into the banking system,” Reuters, October 24).

You might call a gyration in the repo rate a canary in the mine shaft, just like the inverted yield curve (the subject of one of our earlier articles), indicating the possible approach of a recession.

Every investor and every business owner should have an appreciation of the direction in which the economy is headed, as these guide our investment decisions. We trust that reading our blog will provide a level of understanding as to some of the tools used by financial experts.

Les Nemethy is CEO of Euro-Phoenix (www.europhoenix.com), a Central European corporate finance firm, author of Business Exit Planning (www.businessexitplanningbook.com) and a former president of the American Chamber of Commerce in Hungary.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.

.jpg)