Investment funds assets up 0.36% in November, says BAMOSZ

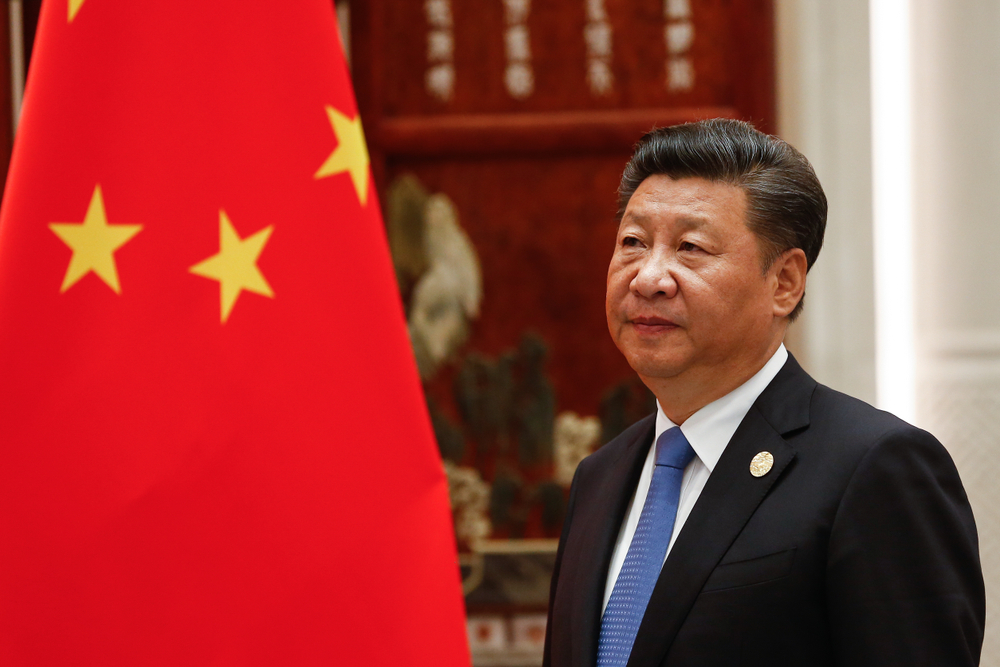

shutterstock

Assets in investment funds managed by members of the Association of Hungarian Investment Fund and Asset Management Companies (BAMOSZ) were up 0.36% at HUF 5.686 trillion in November from the previous month, the association was quoted as saying yesterday by state news agency MTI.

Assets in money market funds fell 0.6% to HUF 984.6 billion on net redemptions of HUF 7.64 bln.

Assets in property funds grew 4.7% to HUF 729 bln as net redemptions reached HUF 3.58 bln.

Assets in derivative funds fell 3.4% to HUF 157 bln on net divestments of HUF 302 million.

Assets in bond funds were down 0.7% at HUF 1.341 tln as investors made net divestments of HUF 7.79 bln.

Mixed fund assets were unchanged at HUF 757 bln, even on net sales of HUF 1.93 bln.

Assets in share funds increased 1% to HUF 273.7 bln as net sales reached HUF 2.28 bln.

Assets in principal-protected funds fell 2.8% to HUF 337 bln as net redemptions reached HUF 12.26 bln.

Assets in absolute-yield funds were up 0.9% at HUF 792 bln with net sales of HUF 7.52 bln.

Assets in commodity funds rose 7.1% to HUF 25.9 bln as net investments were at HUF 1.33 bln.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.