CBRE: High vacancy rates could persist in Budapest

High vacancy rates are expected to persist in Budapest, as well as Amsterdam, Dublin, Madrid, Prague and Warsaw, global real estate advisor CBRE said in an announcement today.

Rental growth, however, is still expected in these markets as empty stock becomes economically redundant due to outdated design or location issues, the announcement said.

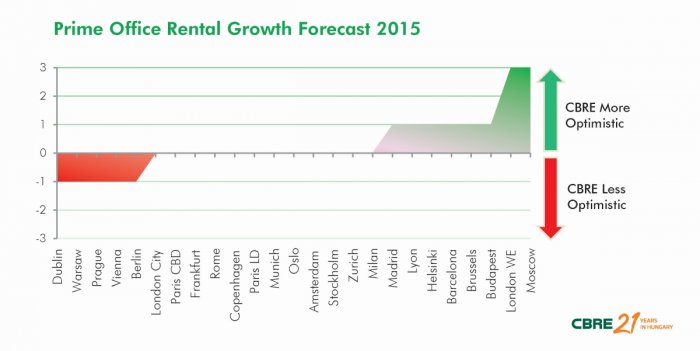

“The positive economic backdrop and employment picture means that nearly all European office markets are forecast to report improved returns for investors in office properties. The extent of optimism around the recovery can be seen in the fact that we expect London, one of the lowest yielding markets, to see a further 50 bps drop in yields over the next year. However, over the next five years, we expect greatest returns to occur in markets such as Budapest, Rome, Madrid and Milan as well as Moscow”, Dr Neil Blake, Head of EMEA Research, CBRE said.

Considering Europe’s prime office market, the vacancy rate is expected to fall back to its 2009 level by the end of 2016 and to continue declining over the rest of the decade, the announcement noted. In Europe’s major cities, office development is not keeping pace with growing demand driven by improving employment trends and almost all key office markets are expected to show falling vacancy rates and accelerated rental growth over the next five years, it added.

“Recent events surrounding Greek debt re-negotiations have obscured what has become a sustained, if uneven, recovery in European economies and this is starting to feed through to Europe’s big office occupier markets. In many cities, office development is not keeping pace with growing demand and almost all major office markets are expected to show falling vacancy rates and rental growth over the next five years, driven by employment growth. ‘Recovering’ cities dominate the employment growth tables for the next five years as corporate confidence grows and expansion plans are executed. As a result, a period of sustained rental growth is expected in most markets,” Blake added with reference to global expectations.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.