BUX up reluctantly

The Budapest Stock Exchangeʼs main BUX index finished up 0.05% at 22,742.94 Friday, after falling 0.52% Thursday. It is up 36.73% from year-end, after losing 10.40% last year. With euro zone markets already picking up sharply, the Budapest parquet only pared losses in the afternoon and reached a meagre gain in close.

Market sentiment is still volatile after earlier, improving, euro area inflation and bank lending data caused some panic that the ECB might cut short its QE, despite the bankʼs affirmation to the contrary. First-rated European sovereign yields shot up, pulling Hungarians also up, but money from bond sales did not find its way into shares as the development suggested rising financing costs.

Friday afternoon German Bund yields changed direction and fell, while corresponding Hungarian yields also dropped at a slower pace. But the reason -- weak German industrial and foreign trade data in the morning -- was not conducive to larger gains in Budapest.

Locally, sentiment is also cautious in view of fresh data on slowing headline deflation and accelerating core inflation, denting optimism for rising household consumption, and before next yearʼs budget bill, while the National Bank of Hungary (MNB) renewed its rear-guard fight on Friday for pressuring banks into increased lending, although the government has said earlier that the cut in the special bank levy for next year would be enacted by parliament in the form as was agreed with EBRD and Erste Group in February, i.e. with no conditionality on, or proportionality to, more lending.

Among individual shares, loser of the day OTP was subdued also on expectations that its operations in Ukraine and Russia still depressed its first quarter with substantial losses and will continue to do so throughout the year. In its core market, Hungary, OTP likely saw an improvement in risk costs, but profit margins there probably declined on the back of the conversion of foreign-currency mortgages into the local currency, as well as due to more fierce competition, Concorde Securities said prior to OTPʼs earnings report scheduled for May 15. Concorde maintained its underweight recommendation, with a HUF 4,667 end-2015 target price.

Investors also kept distance for most of the day from MOL while they digested the companyʼs first-quarter report with steeply rising core earnings, but with an equally diving bottom line due to financial losses. The share shot up in late trades.

Magyar Telekom shares are the best play on Hungaryʼs economic recovery, Concorde Securities also said before the companyʼs first-quarter results due on May 12. Concorde confirmed its overweight recommendation, with a HUF 480 year-end target price.

However, after so many disappointments over recent years, investors doubted local media reports on Friday, citing unspecified government sources, that Hungaryʼs government might reduce several taxes on the telecoms sector in the coming years. The prime minister has already said on Thursday that the special telecoms tax was to stay in 2016.

Richter did not benefit much either from a note of Goldman Sachs out Friday in which it raised its target price for Richter to HUF 3,010 from HUF 2,659 previously, as the new target price is still way below the current share price. Goldman also maintained its "sell" recommendation.

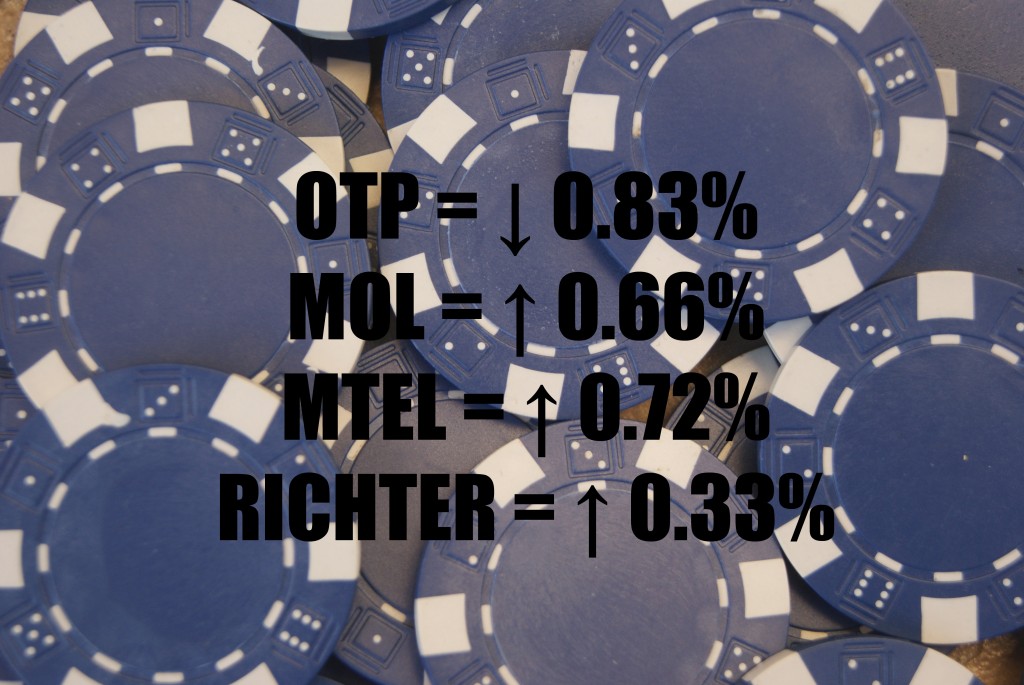

OTP lost 0.83% to HUF 5,950 on turnover of HUF 3.64 bln from a HUF 9.50 bln session total, a tenth short of the daily average this year.

MOL ended up 0.66% at HUF 15,350 on turnover of HUF 3.98 bln.

Magyar Telekom gained 0.72% to HUF 418 on turnover of HUF 246 mln.

Richter advanced 0.33% to HUF 4,555 on turnover of HUF 1.55 bln.

The bourseʼs mid-cap BUMIX went out 0.02% higher at 1,634.03.

Over the week, the BUX was up 0.58% after rising 0.86% in the previous, holiday-shortened, week.

OTP dropped 0.92% after garnering 2.68% last week.

MOL improved 1.99% after rising 1.01% the previous week.

Magyar Telekom rose 3.21% after falling 1.22% last week.

Richter shed 0.13% after losing 0.85% over the previous week.

The BUMIX won 1.32% after pocketing 0.53% over last week.

Elsewhere in the region, WIG 20 in Warsaw was up 1,10%. Pragueʼs stock exchange was closed for Victory Day. Western Europeʼs major indices were all up ahead of their close Friday, FTSE100 in London 2.17%, DAX30 in Frankfurt 2.56%, and CAC40 in Paris 2.41%.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.