BUX inches up in final trades

The Budapest Stock Exchangeʼs main BUX index finished up 0.12% at 21,720.15 Wednesday after falling 0.49% Tuesday. It is up 30.58% from year-end, after losing 10.40% last year.

Supported by MOL on rising fuel prices, the Budapest parquet edged up in very final trades after inching down for a fourth previously as investors all over Europe waited for clues on US interest rates from the Fed later in the evening, and ahead a meeting on Thursday of European finance ministers on Greece with little prospect of a breakthrough.

The dayʼs loser was OTP, after its managers apparently continued to sell the bankʼs shares.

Falling 3.19% on Tuesday on further delays in the approval process of one of its drugs in the US, Richterʼs course corrected up in last minutes trades after balancing all day long between the pharma companyʼs announcement that it was to buy 150,000 treasury shares on Wednesday, and a reminder of a government official on public television of the damage EU sanctions against Russia caused to Hungary. Exports to Russia dropped 14.5% year-on-year in the fourth quarter of 2014 and plunged an annual 52% in the first quarter of this year, the official said. Richter is heavily exposed to Russian and Ukrainian markets.

Magyar Telekom did not react positively to news that its parent, Deutsche Telekom conducted talks with would-be buyers of its US unit, T-Mobile US, as all earlier expectations that Deutsche Telekom would spend any special income to buy out its Hungarian subsidiary were disappointed.

Local political uncertainties also weighed.

A new row with the EU is looming as the Hungarian government has decided to fence off its border with Serbia to stop a relatively small stream of refugees mostly from war-torn Middle Eastern countries.

An ageing country plagued by emigration for economic reasons, Hungary should rather welcome an infusion of immigrant taxpayers, opposition parties say, adding that the governmentʼs policies may also hurt the chance of Hungarians to find work abroad.

While the Hungarian government deems the majority of asylum seekers illegal "bread and butter immigrants" who threaten workplaces in Hungary, and has started a public relations campaign to alert citizens to what it terms a "danger", a move that was condemned as xenophobic by the European Parliament recently, a new survey showed Hungary ranked fourth among the 19 remittance-receiving countries within Europe.

Last year migrant workers living in Europe sent home USD 109.4 bln in remittances. Of that amount, USD 4.473 bln, or 4.1% of the total, has been sent to Hungary, according to a report by the International Fund for Agricultural Development (IFAD).

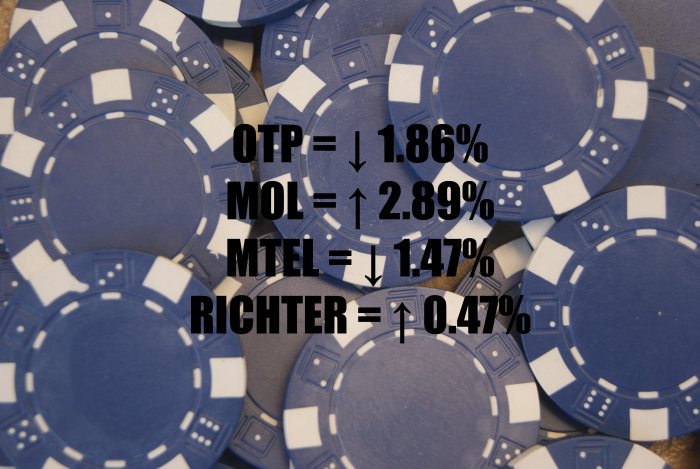

OTP lost 1.86% to HUF 5,320 on turnover of HUF 6.78 bln from a HUF 10.27 bln session total, in line with the daily average this year.

MOL rose 2.89% to HUF 14,765 on turnover of HUF 1.21 bln.

Magyar Telekom fell 1.47% to HUF 403 on turnover of HUF 526 mln.

Richter advanced 0.47% to HUF 4,270 on turnover of HUF 1.62 bln.

The bourseʼs mid-cap BUMIX went out 0.17% higher at 1,652.77.

Elsewhere in the region, WIG 20 in Warsaw was down 1.59%, while Pragueʼs PX fell 1.22%. Western Europeʼs major indices were all down ahead of their close Wednesday, FTSE100 in London 0.22%, DAX30 in Frankfurt 0.30%, and CAC40 in Paris 0.71%.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.