BUX down in slow trade

The Budapest Stock Exchangeʼs main BUX index finished down 1.04% at 22,151.40 Monday after rising 0.31% Friday. It is up 33.17% from year-end, after losing 10.40% last year. Over last week, it dropped 0.47% after rising 1.93% the previous week.

Along with global and Central European markets, the Budapest parquet started off on a weak footing on Monday in slow trade, with a plunge in Chinese stocks weighing on sentiment, and investors cautious ahead of the Fedʼs meeting that ends on Wednesday and Thursdayʼs advance estimate of US second-quarter GDP.

In Hungary, GKI-Ersteʼs business confidence index out on Monday edged down to 5.0 points in July from 5.1 in the previous month, while the consumer confidence index, still in the doldrums, improved to minus 26.0 points from minus 27.0.

Goldman Sachs has downgraded Hungarian oil and gas group MOL to "sell" from "neutral" ahead of the company’s u%oming quarterly earnings report, and cut its target price to HUF 13,500 from HUF 16,000.

A confirmation on Monday from Croatiaʼs constitutional court that it has annulled a prison verdict of former Croatian prime minister Ivo Sanader for, among other charges, allegedly taking bribes from MOL for giving it a large stake and management rights in its Croatian peer, INA, in 2009, did not help MOL, because the court did not dwell on the merits of the case, but ordered a retrial of Sanader to correct procedural errors.

First analystsʼ projections for pharma company Richter which is due to report on its second quarter this week, penciled in a 0.7% revenue drop, an operative profit growth of 23% and a net profit fall of nearly 28%.

OTP Bank was also subdued after the National Economy Ministry said on Monday that financial institutions have so far credited their clients HUF 744 bln for past bank practices deemed irregular by retroactive legislation last autumn, and also said the ministry has already prepared its plan for a voluntary swap with incentives of forex car and personal loans into forint debts.

Meanwhile, uncertainty around the future leadership of the Hungarian tax authority and a reform at the office the details of which are unknown also dents confidence, while local media report that "swarms" of tax authority employees escape by giving notice.

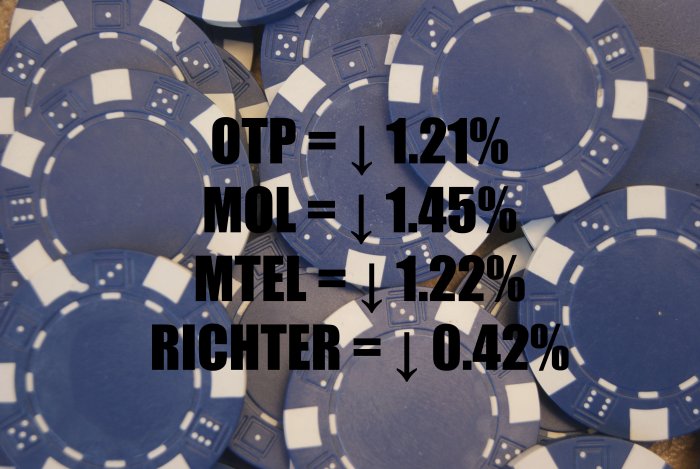

OTP lost 1.21% to HUF 5,730 on turnover of HUF 3.00 bln from a HUF 6.02 bln session total, less than two-thirds of the daily average this year.

MOL fell 1.45% to HUF 14,320 on turnover of HUF 1.38 bln.

Magyar Telekom dipped 1.22% to HUF 404 on turnover of HUF 419m.

Richter retreated 0.42% to HUF 4,301 on turnover of HUF 1.13 bln.

The bourseʼs mid-cap BUMIX went out 1.04% lower at 1,6.

Elsewhere in the region, WIG 20 in Warsaw was up 0.06%, while Pragueʼs PX let 0.47% go.

Western Europeʼs major indices were all down ahead of their close on Monday, FTSE100 in London 1.12%, DAX30 in Frankfurt 2.49%, and CAC40 in Paris 2.61%.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.