Fitch assigns ‘A’ rating to Bank of Chinaʼs notes issued in Hungary

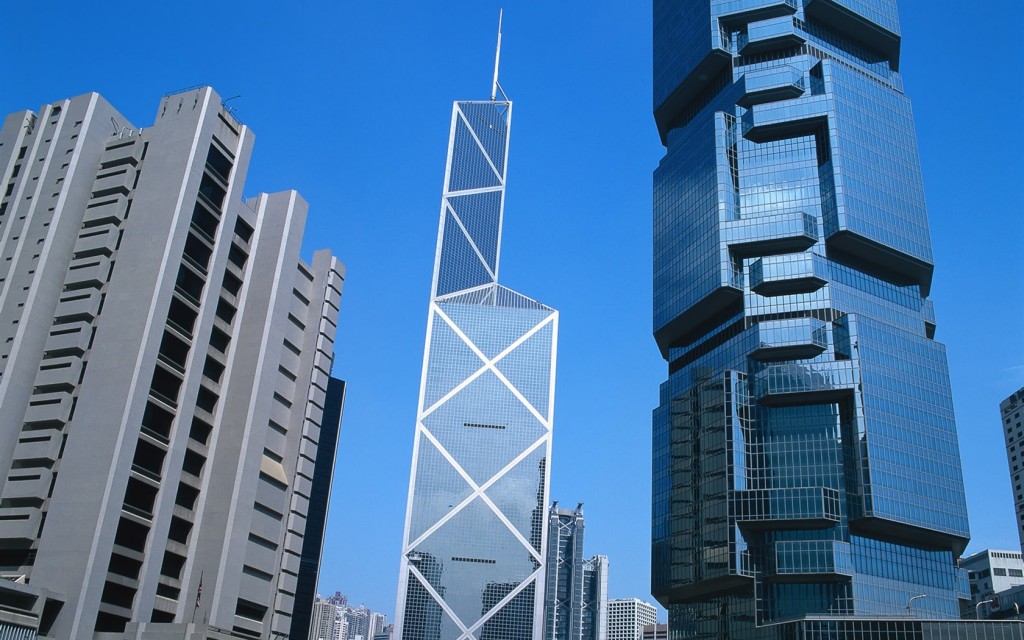

Fitch Ratings has assigned Bank of Chinaʼs long-term notes issued, under its medium-term note (MTN) program, a final ‘A’ rating on Wednesday, based on similar expected ‘A’ ratings to the notes from Bank of Chinaʼs branches in Hungary, Hong Kong, Abu Dhabi and Singapore.

The rating covers an issue of €500 mln with three-year maturity issued by Bank of Chinaʼs Hungarian branch.

The ‘A’ rating assigned to the notes issued by the Hungarian branch is higher than the country ceiling of ‘BBB’ for Hungary, "underpinned by our expectation of full support from the bankʼs headquarters to the branch," Fitch noted.

The Hungarian branch of the Bank of China will use proceeds from the €500 mln bond, issued at the end of last month, for upgrades at local chemicals company BorsodChem, in eastern Hungary, a member of Chinaʼs Wanhua group, and state-owned Hungarian Electricity Works (MVM), as well as several other local businesses, the head of the branch, Chen Huaiyu said earlier.

The bond issue followed a memorandum of understanding between China and Hungary on their governmentsʼ support for the establishment of the Silk Road Economic Belt and the 21st Maritime Silk Road signed earlier in June.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.