Hotel Visits Returning to 2019 Levels

The W Hotel Budapest in the restored Drechsler Palace, construction for which was supervised by the DVM group.

Guest nights for Budapest are now returning toward pre-pandemic 2019 levels after COVID, followed by broad geopolitical, economic and financial issues, hit tourism hard, on top of concerns over demand and spending power, not to mention rising development, labor and operational costs.

Despite some of the perceived complexities regarding hotel and hospitality projects compared to other commercial property market sectors, the field has successfully attracted investors and developers from the more traditional areas such as office and industrial.

Investors and developers are concluding long-term lease or franchise partnerships with branded and experienced hotel operators; the latter provides the hotel expertise while, in theory, leaving the former to concentrate on their portfolios. Although several projects have been put on hold or are subject to delays, there are still many ongoing pipeline developments based on such commercial partnerships.

Tourism figures for Budapest are once again robust, with total guest nights of 4.2 million recorded in the first half of 2023, according to CBRE. Foreign guest figures were up 16% year-on-year, representing 81% of the guest nights in the capital.

“We are definitely seeing improvement; room nights in Budapest are close to reaching pre-pandemic levels, and with the increase in average daily room rates, we are hopefully close to stabilizing. Profitability still suffers, but the outlook is positive,” says Péter Takács, partner at the consultants, Newmark VLK Hungary.

Summer tourism indicators have beaten records set in 2019, the last full year before the COVID lockdowns, according to the Hungarian Tourism Agency. As many as 6.2 million tourism visits were recorded in Hungarian tourism accommodations in June-August, 6% more than in the same period of summer 2019.

Attila Radvánszki, director of Horwath HTL Hungary, says there are two critical external factors to consider when considering tourism numbers in Budapest. The first is financial stability in crucial source markets, which, he says, is closely tied to their economic health.

“If economies in these countries face downturns or recessions, it might reflect in reduced outbound travel to destinations like Budapest.” The second factor Radvánszki identifies is geopolitical situations.

European Geopolitics

“The ongoing armed conflict in neighboring Ukraine can impact travel sentiment and decisions. While Budapest remains a safe and attractive destination, any escalation in the conflict might deter potential travelers, especially those from regions not familiar with European geopolitics,” he says.

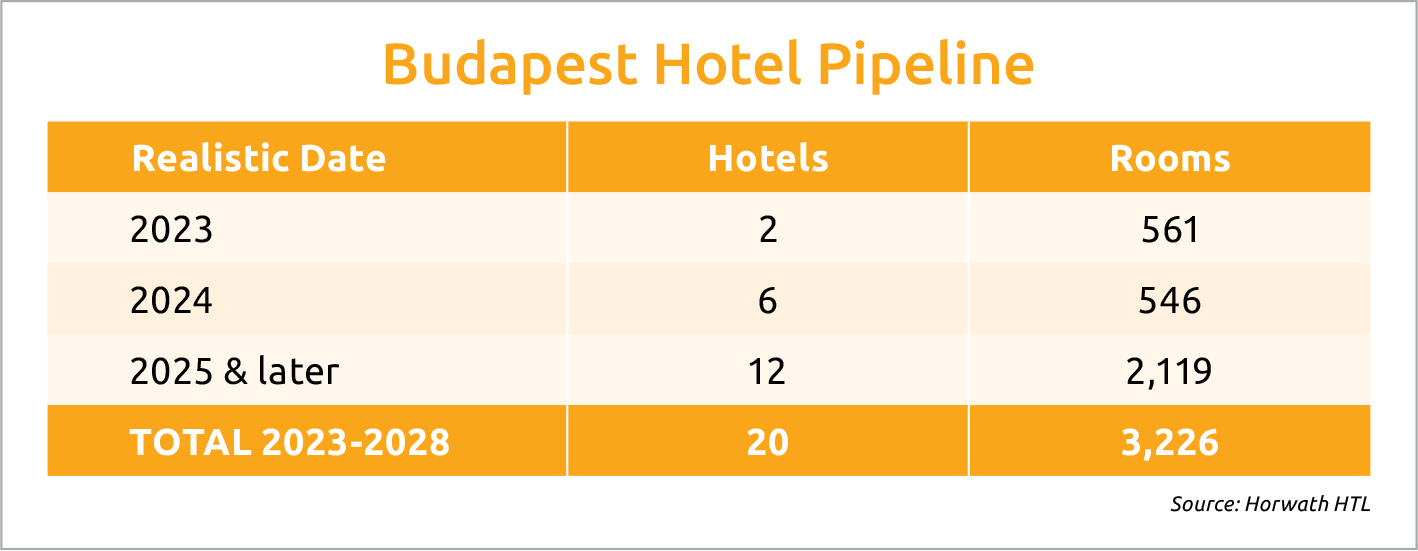

The Budapest pipeline for the remainder of this year is put at two hotels, totaling 560 rooms. A further six hotels, totaling 546 rooms, are due to be delivered next year, according to Horwath HTL Hungary. The total pipeline for 2023-2028 is put at 20 hotels with 3,226 rooms.

Radvánszki says the highlights from the pipeline are the Dorothea Autograph Collection, due later this year or early next; the Kimpton Budapest and Radisson Collection, scheduled to open next summer; the St. Regis (the refurbished Sofitel), due in 2024-2025; and the renovated landmark Gellért Hotel, which is slated to open in 2026-2027.

The acquisition of the Sofitel from Indotek by BDPST in March 2023 is seen as a significant investment deal, although further hotel transactions are not expected in 2023.

“The [Marriott] Moxy Budapest Downtown on Kazinczy utca, and the Dorothea close to Vörösmarty tér, are definitely worth attention, and we hope the St. Regis project will come back ontrack. […] We also expect new hotels to appear soon as a result of the conversion of an existing office building as well as renovations and rebrandings of existing hotel properties,” says Péter Takács of the pipeline projects.

W Hotels, part of the Marriott brand, opened the 150-room and suite luxury W Budapest in July following the renovation of the 16,000 sqm Drechsler Palace on the UNESCO-listed Andrássy út. The project, by the Qatari group QPR Properties, was ongoing for several years and subject to a number of delays, reflecting the difficulties of developing in the historic center with strict and often complex planning regulations that require permissions from both city and heritage authorities.

A notable trend in the Budapest hotel market has been the purchase and redevelopment of 19th and early 20th-century Central European palaces into hotels, giving the buildings a use-value while at the same time maintaining the classic feel of the city.

Cross-sector Developers

The hotel market has attracted developers who operate across different sectors. The Hungarian regional developer and investor Wing has concluded an agreement with Accor for a 12,000 sqm hotel within the 42,000 sqm Liberty office development in Budapest. This will be a dual-branded hotel in Hungary, with Ibis and Tribe Hotel each operating half of the 332 rooms.

Wing (as developers) and IHG Hotels & Resorts (as operators) have also signed a contract for the Hotel Indigo Budapest Andrássy and Holiday Inn Express, which will deliver a combined 265 rooms.

“Wing’s hotel portfolio has grown significantly in recent years, and a number of top international hotel brands have chosen our developments,” comments Noah Steinberg, the chairman and CEO of the developer.

“Wing will join an elite club of real estate developers that have completed at least 1,000 hotel rooms. Diversifying our hotel developments, both in terms of location and brands, is an important part of our strategy, so we are delighted to welcome two highly successful brands from the prestigious IHG Hotels & Resorts family to our projects,” he adds.

The Hungarian hotel investor and developer, BDPST, has bought the 100-year-old heritage-listed Gellért Hotel in Budapest from Indotek Group, and a comprehensive restoration of the interior into a 145-room, five-star hotel has begun. The renovation, designed by Archikon, has a scheduled completion of 2026.

“ESG matters most to institutional investors who are currently quite passive in our region. The cost of energy, however, is a strong motivator for owners and developers to optimize their building’s performance and efficiency,” says Takács of Newmark VLK Hungary.

Pipeline outside the capital is put at approximately 3,000 hotel rooms within three to four years, focusing mainly on the Balaton region and larger secondary cities like Debrecen to supplement industrial development projects. The first 102-room Marriott hotel outside the capital in Balatonfüred (127 km southwest of Budapest by road on the northern shore of Lake Balaton) by Hungarian developers is due to be completed in 2025.

This article was first published in the Budapest Business Journal print issue of October 20, 2023.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.