Experts: CPI dip no surprise; base lending rate wonʼt change

Today’s report that the Consumer Price Index fell by 0.2% in June on a year-on-year basis matched market expectations, experts said. They added that there is no reason for concern about the trend, and that they expect the central bank to keep the base lending rate on hold for now.

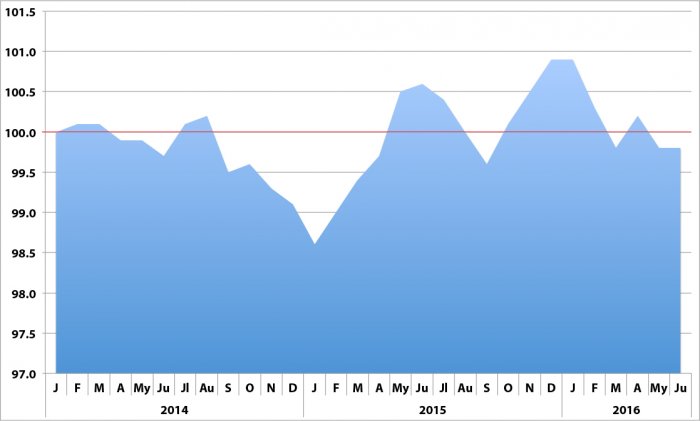

Monthly Consumer Price Index in Hungary. Corresponding period of the previous year = 100. (Source: Central Statistical Office)

The CPI was primarily dragged down by dropping fuel prices, but food has become somewhat cheaper as well compared to a year ago, according to the report from the Central Statistical Office (KSH). In contrast, the price of alcoholic beverages and tobacco rose sharply, as did the costs of services, KSH reported.

Experts said the trend does not raise concerns about deflation, as the main cause for this development is the global drop in oil prices, not internal structural problems. Discounting fuel prices, inflation would be going up as a result of growing wages due to chronic lack of labor in Hungary, experts said.

Analysts at CIB said there is no reason to modify their forecast for either inflation or monetary policy trends. “We do not expect a change in the current trend of service prices or durable goods prices; we foresee inflation to remain in negative territory y-o-y in July. According to our forecast, this should be followed by gradual rise, moving above 1% at the end of the year. Annual average CPI may come close to 0.6%, showing that the June figure should not reshuffle inflation expectations. We do not expect changes in the monetary policy outlook either,” according to a CIB flash report issued today.

Equilor agreed, noting that there is actually some inflationary pressure in the domestic market as labor demand is on the rise and there is clear upward pressure on wages. Nonetheless, due to the low inflation, the Hungarian National Bank (MNB) may keep its base rate on a low level permanently, according to Equilor’s analysis released today.

“Because of uncertainties arising in the aftermath of Brexit, cutting the base rate is pretty much out of the question in the short term. Yet if central banks in developed markets eventually go for aggressive easing yet again at a later point, MNB may follow suit, but it would probably rely on non-conventional tools at first if needed. Our projected scenario therefore hasnʼt changed, and in the second half of the year (and even in early 2017) the base rate should remain unchanged,” the Equilor analysis said.

SUPPORT THE BUDAPEST BUSINESS JOURNAL

Producing journalism that is worthy of the name is a costly business. For 27 years, the publishers, editors and reporters of the Budapest Business Journal have striven to bring you business news that works, information that you can trust, that is factual, accurate and presented without fear or favor.

Newspaper organizations across the globe have struggled to find a business model that allows them to continue to excel, without compromising their ability to perform. Most recently, some have experimented with the idea of involving their most important stakeholders, their readers.

We would like to offer that same opportunity to our readers. We would like to invite you to help us deliver the quality business journalism you require. Hit our Support the BBJ button and you can choose the how much and how often you send us your contributions.